Voluntary benefits

Critical Illness

Cover the extra costs that come with a serious illness.

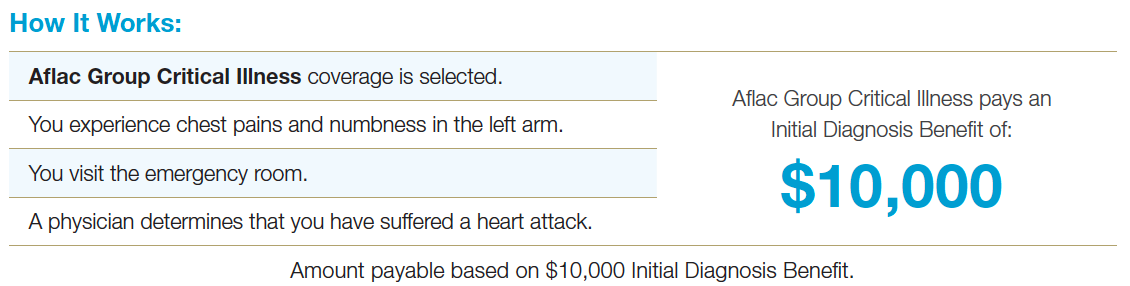

Aflac’s Critical Illness plan provides ability for an insured to receive a lump sum benefit payment upon first and second diagnosis of any qualified critical illness. It is a supplemental option to your medical plan, no matter what type of coverage you have.

Features:

• Benefits are paid directly to you, unless otherwise assigned.

• Coverage is available for you, your spouse, and dependent children.

• Coverage may be continued (with certain stipulations). That means you can take it with you if you change jobs or retire.

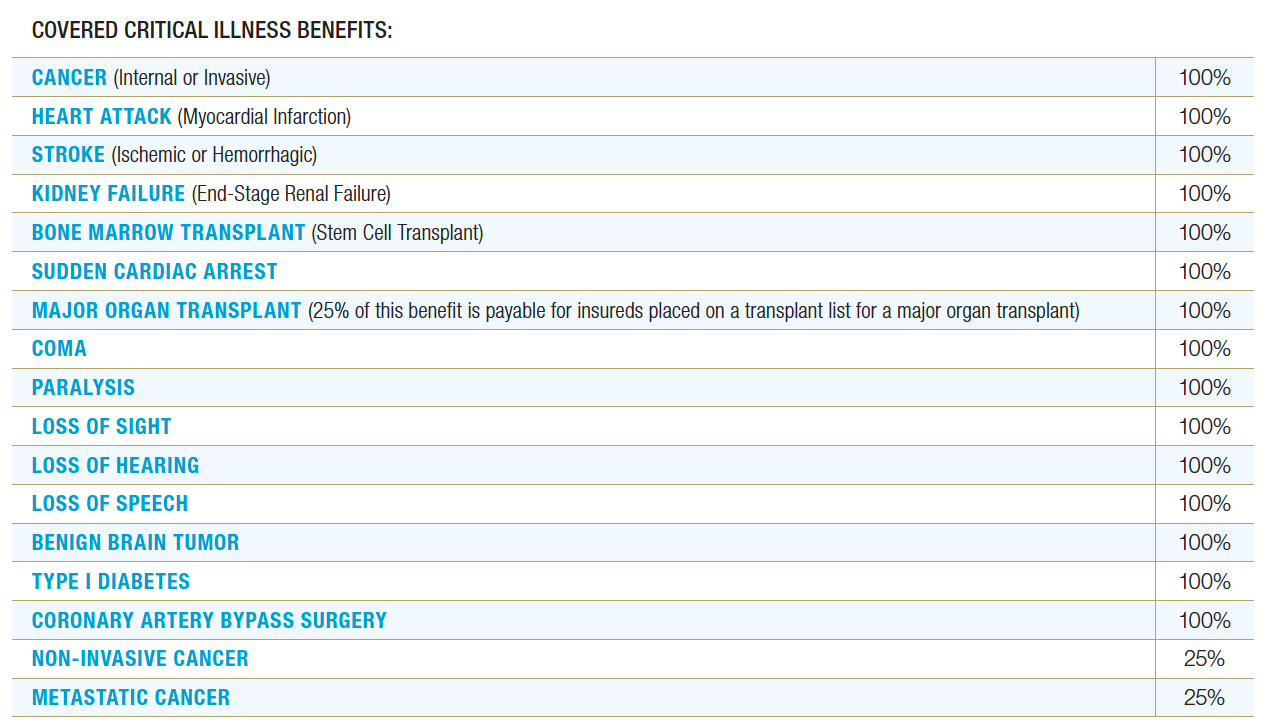

The chart below shows the a list of some of the covered illnesses:

Click here for more information

Payable for health screening tests performed while an insured’s coverage is in force. We will pay this benefit once per calendaryear, per insured. This benefit is only payable for health screening tests performed as the result of preventive care, including tests and diagnostic procedures ordered in connection with routine examinations.