Dental Low Plan

You pay a higher percentage for services than the High Plan

Katy ISD offers two dental plans. While both pay 100% of the cost for preventive care, the plans differ in coverages depending on the services you need and the dentist you see.

*New this year: these plans have both in and out of network coverages. Also, both plans have a maximum yearly benefit of $1,000.

Aflac Dental frequently asked questions can be found here.

You pay a higher percentage for services than the High Plan

Dental Low Plan

Low Plan

There are no copays on this plan. You’ll pay a deductible for both basic and major services. Both of these services are then covered at a percentage of the cost. There is no coverage for orthodontia on this plan. You can visit any dentist you choose, but using an in-network dentist can save you money. Remember, you have a maximum yearly benefit of $1,000.

Get started with our refreshed Member Portal or Scan the QR code.

Aflac Member Portal registration instructions help.

You can use any dentist you choose; however, your costs are lower if you use an in-network dentist. If you’d like to find an in-network dentist prior to enrolling in this plan, visit Aflac providers list or call Aflac's KISD dedicated Dental line at 877-675-7277, Monday – Friday: 8AM – 8PM (ET).

Click here to search for providers.

Have Questions? Call Aflac's KISD dedicated Dental line at 877-675-7277, Monday – Friday: 8AM – 8PM (ET) or visit the Dental FAQs.

Aflac Member Portal USER GUIDE

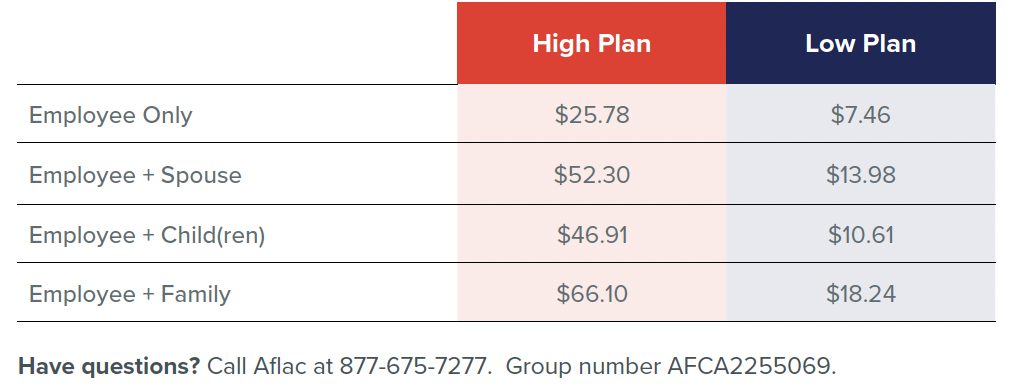

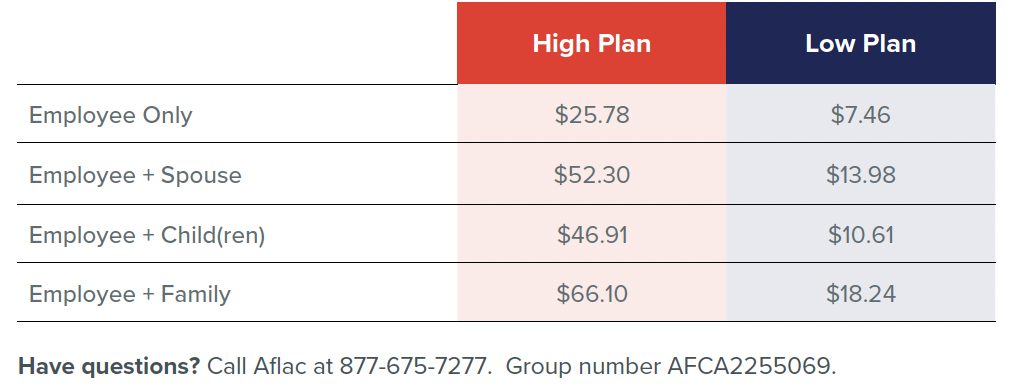

| Rates per pay period | |

|---|---|

| Based on 24 pay periods | |

| Employee | $7.46 |

| Employee + Spouse | $13.98 |

| Employee + Child(ren) | $10.61 |

| Employee + Family | $18.24 |

| Annual deductible | |

|---|---|

| Individual | $25.00 |

| Family | $75.00 |

| Annual benefit maximum | |

|---|---|

$1,000 |

|

| Covered services | You pay |

|---|---|

| check Preventive | Covered at 100% |

Freedom to see any dentist, but using an in-network dentist can save you money.

Dental High Plan

You’ll pay a deductible for basic, major, and orthodontic care. You can visit any dentist you choose, but using an in-network dentist can save you money.

High Plan

You’ll pay a deductible for basic, major, and orthodontic care. You can visit any dentist you choose, but using an in-network dentist can save you money.

Remember, you have a maximum yearly benefit of $1,000.

You’ll pay a deductible for basic, major, and orthodontic care. You can visit any dentist you choose, but using an in-network dentist can save you money. Remember, you have a maximum yearly benefit of $1,000.

Get started with our refreshed Member Portal or Scan the QR code.

Aflac Member Portal registration instructions.

You can use any dentist you choose; however, your costs are lower if you use an in-network dentist. If you’d like to find an in-network dentist prior to enrolling in this plan, visit Aflac providers list or call Aflac's KISD dedicated Dental line at 877-675-7277, Monday – Friday: 8AM – 8PM (ET).

Click here to search for providers

Aflac Dental & Vision Insurance frequently asked questions can be found here.

Aflac Member Portal USER GUIDE

Have questions? Call Aflac's KISD dedicated Dental line at 877-675-7277, Monday – Friday: 8AM – 8PM (ET).

| Rates per pay period | |

|---|---|

| Employee | $25.78 |

| Employee + Spouse | $52.30 |

| Employee + Child(ren) | $46.91 |

| Employee + Family | $66.10 |

| Annual deductible | |

|---|---|

| Individual | $50 |

| Family | $150 |

| Annual benefit maximum | |

|---|---|

$1,000 |

|

| Covered services | You pay |

|---|

| Dental Low Plan | Dental High Plan | |||

|---|---|---|---|---|

| Rates per pay period | ||||

| $7.46 | $25.78 | |||

| Annual deductible | ||||

|

Individual $25.00 Family $75.00 |

Individual $50 Family $150 |

|||

| Annual benefit maximum | ||||

$1,000 |

$1,000 |

|||

| Covered services | ||||