Voluntary benefits

Disability

Income replacement if you’re unable to work

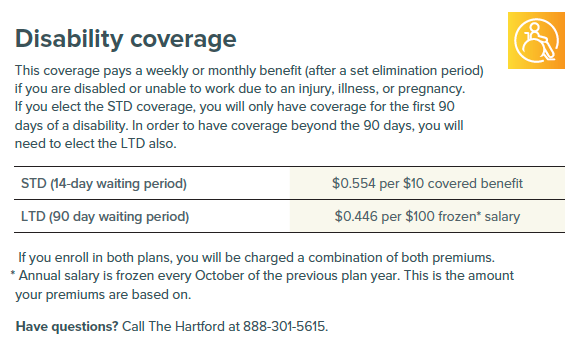

Disability coverage helps replace a portion of your income if you’re unable to work due to an injury, illness or pregnancy. The district offers coverage through The Hartford.

- Choose from two plans, short-term disability (STD) 14 day waiting period or long-term disability (LTD) 90 day waiting period

- STD (14 day waiting period) plan rate is $0.554 per $10 covered benefit and LTD (90 day waiting period) plan rate is $0.446 per $100 frozen salary.

- Benefits may be reduced by other sources of income such as Workers Compensation, TRS, and Social Security.

- Benefits are non-taxable since the premiums are deducted after tax.

Base earnings are calculated from your salary as of the October before your disability and don’t include bonuses, commissions, overtime pay, shift differential, employer contributions on your behalf to any deferred compensation or pension plan or any other extra compensation.

The waiting period is the amount of time you must be disabled before you’re eligible to receive a disability benefit.

You might consider choosing your plan based on the number of sick/personal days you have. For example, if you have a lot of sick/personal days available, you might choose the Long-term disability plan (90 day waiting period) before your disability benefits begin.

To file a disability claim, print the claim form and complete according to the instructions. There are three parts — one for you, one for your physician and one for your employer, Katy ISD. Return the completed employee and physician sections to the Risk Management Office in the Education Support Complex. The Risk Management team fills out the employer portion of the form and we will submit it to The Hartford. For assistance during this process, call Katy ISD Risk Management at 281-396-2324.

To determine your premium for disability, you can use the Price Your Plan tool or go to Resources, then Forms, then Disability and use the worksheets to help you determine either Short Term or Long Term disability premiums.

Once approved, your benefits start the day after your waiting period ends. Benefits may continue during disability until you recover or reach the maximum benefit period.

The duration of your benefits is based on your age at disability.

| Provision description | |

| Age when disability begins | Maximum benefit period |

| Less than 60 | To age 65, (more than 5 years) |

| 60 | 60 months (5 years) |

| 61 | 48 months (4 years) |

| 62 | 42 months (3 years 6 months) |

| 63 | 36 months (3 years) |

| 64 | 30 months (2 years 6 months) |

| 65 | 24 months (2 years) |

| 66 | 21 months (1 year 9 months) |

| 67 | 18 months (1 year 6 months) |

| 68 | 15 months (1 year 3 months) |

| 69 and over | 12 months (1 year) |

Your payments stop on the earliest of the following:

- During the first 24 months of payment, when you are able to work in your regular occupation (see definition below) on a part-time basis but you do not

- After 24 months of payment, when you are able to work in any gainful occupation (see definition below) on a part-time basis but you do not

- After 12 months of payment if you reside outside the US or Canada for six months or more during any 12 consecutive months of benefits

- The end of the maximum period of payment

- The date you are no longer disabled under the terms of the plan (unless you’re eligible to receive benefits under the Rehabilitation and Return to Work assistance program)

- The date your disability earnings exceed the amount allowable under the plan

- In the event of your death

- The date you fail to submit proof of continuing disability

You’re considered disabled if, as a result of physical disease, injury, pregnancy or mental disorder, you are receiving Appropriate Care and Treatment and complying with the requirements of such treatment; and you’re unable to perform the material duties of your regular occupation that you are routinely performing when your disability begins and suffer an earnings loss of at least 20% of your indexed pre-disability earnings when working in your regular occupation. You’re not considered disabled during this period because of a loss of license or something similar that restricts your right to perform your occupation.

You’re considered disabled if, as a result of physical disease, injury, pregnancy or mental disorder, you are receiving Appropriate Care and Treatment and complying with the requirements of such treatment; and you’re unable to perform the duties of any gainful occupation for which you are reasonably qualified taking into account your training, education and experience.

Disabled or Disability means that, due to sickness or as a direct result of accidental injury:

- You are receiving Appropriate Care and Treatment and complying with the requirements of such treatment; and

- You are unable to earn;

- During the elimination period and the next 24 months of sickness or accidental injury, more than 80% of your pre-disability earnings at your own occupation from any employer in your local economy, and;

- After such period more than 60% of your pre-disability earnings from any employer in your local economy at any gainful occupation for which you are reasonably qualified taking into account your training, education and experience.

For purposes of determining whether a disability is the direct result of an accidental injury, the disability must have occurred within 90 days of the accidental injury and resulted from such injury independent of other causes.

This plan doesn’t cover pre-existing conditions for the first 12 months after your effective date of coverage for long-term disability claims (disabilities that last longer than 90 days). You have a pre-existing condition if:

-

You received medical treatment, consultation, care or services, including diagnostic measures, or took prescribed drugs or medicines in the three months prior to your effective date of coverage and;

-

The disability begins in the first 12 months after your effective date of coverage.

The pre-existing exclusion does not apply to disabilities lasting more than 14 days and less than 90 days.

If you’re not actively at work when coverage is scheduled to become effective, your coverage doesn't take effect until you complete your first day at work. Paid leave and paid vacation are not considered being actively at work.

For more information, refer to the insurance certificate available from the Katy ISD Risk Management office or call The Hartford customer service at 888-301-5615.

Also, see the disability plan FAQs

Visit the The Hartford website to:

- Monitor your claim

- Sign up for direct deposit of your claim payment

- Update your contact information

- File a maternity claim in advance

- Report your return-to-work date

- Name a beneficiary

- Find answers to your disability benefits questions

Important: The information provided on this page is not the official policy. In the case of discrepancies, the policy governs.

Important: The information provided on this page is not the official policy. In the case of discrepancies, the policy governs.