Voluntary benefits

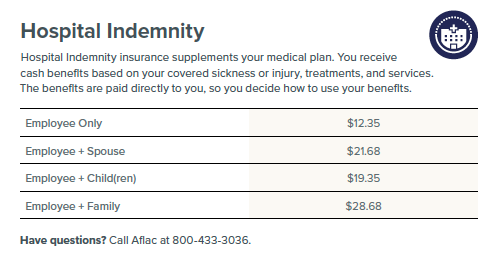

Hospital Indemnity

The plan that can help with expenses and protect your savings.

Does your major medical insurance cover all of your bills? Even a minor trip to the hospital can present you with unexpected expenses and medical bills. And even with major medical insurance, your plan may only pay a portion of your entire stay.

It provides financial assistance to enhance your current coverage. It may help avoid dipping into savings or having to borrow to address out-of-pocket-expenses major medical insurance was never intended to cover. Like transportation and meals for family members, help with child care, or time away from work, for instance.

The Aflac Group Hospital Indemnity plan benefits include the following:

• Hospital Confinement Benefit

• Hospital Admission Benefit

• Hospital Intensive Care Benefit and more

Click here for more information.

This plan pays $1,000 (once per covered sickness or accident per calendar year for each insured) and $200 per confinement for each covered sickness or accident for each insured up to a maximum of 15 days.

For example, if you have a high fever and go to the emergency room, the physician admits you into the hospital and you are released after two days, the plan would pay $1,400. The amount payable is generated based on the benefit amounts for Hospital Admission ($1,000) and Hospital Confinement ($200 per day).

The Health Screening Benefit is payable once per calendar year for health screening tests performed as the result of preventive care, including tests and diagnostic procedures ordered in connection with routine examinations. This benefit is payable for each insured.