Voluntary benefits

Permanent Life Policy

Aflac makes simple and affordable life coverage available to help keep your loved ones financially secure, even if you can no longer provide for them.

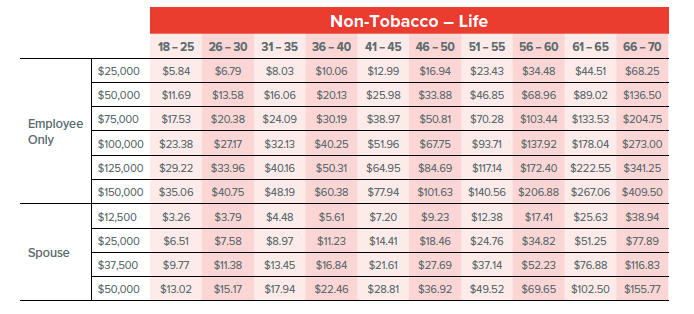

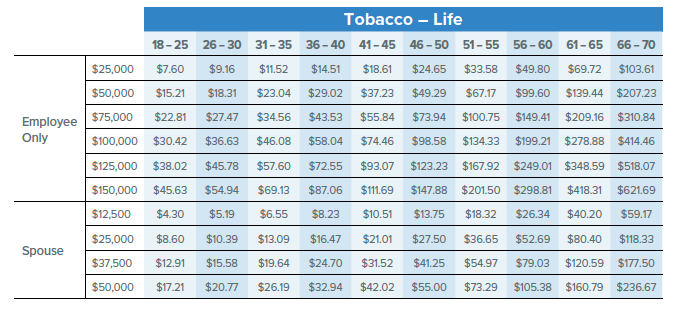

The employee’s spouse may also be enrolled for a benefit of 50% of the employee’s benefit. The premiums for spouse coverage are based on the spouse’s age at the time of enrollment.

- There are premiums for both tobacco users and non-tobacco users.

- The benefits reduce at age 70 or after 10 years of coverage, whichever is later.

- This coverage is portable, so you are able to continue this policy after you leave the district.

The AFLAC Group Term Life to 120 plan is a new coverage available to be purchased by employees between ages 18-70. The premium is based upon the employee’s age at the time of enrollment.

Once the AFLAC Group Term Life to 120 policy is issued, the rates for the policy shall remain unchanged until the age of 120.

There are premiums for both tobacco users and non-tobacco users.

The employee’s spouse may also be enrolled for a benefit of 50% of the employee’s benefit. The premiums for spouse coverage are based on the spouse’s age at the time of enrollment.

Read more about the plan here.

During Annual Enrollment (From November 12th to November 21st, 2025, for the 2026 plan year), there are no medical questions to complete when applying for coverage.

Coverage is guaranteed up to:

- Employee Amount up to $150,000

- Spouse Amount up to lessor of $50,000 or 50% of employee benefit amount

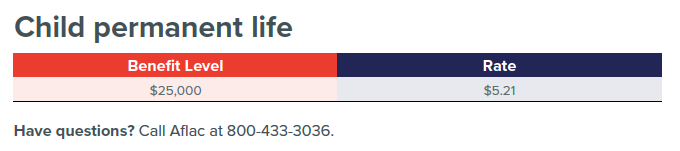

- Child $25,000.

The AFLAC Group Term Life to 120 plan includes a unique Accelerated Benefit rider that gives you the option on how you are paid in the event of a permanent chronic condition or terminal illness.

- If you are diagnosed with a terminal illness, you can request a one time lump sum benefit of up to 50% of the life insurance benefit to be payable.

- If you are diagnosed with a chronic condition, you can choose a one-time lump sum benefit of up to 50% of the Life Insurance Benefit

- Or you can choose periodic payments in the amount of 4% of the Life Insurance Benefit (maximum of 25 payments). Each additional periodic payment must be separated by a period of 30 days or more. Any payment made under the Accelerated Benefit Rider will automatically reduce the Death Benefit payable under the certificate by the amount paid under the rider. If periodic payments have been made for a chronic condition and you later request a lump sum benefit for terminal illness, the amount payable will be less any amount paid previously under the rider.

- Once a lump sum benefit has been paid under the rider, no further benefits will be paid and rider coverage will end for the insured.

- In case your chronic condition continues, you may prolong the routine payments for an added 25 payments. Once you have attained the maximum extension, there shall be no further payments.

This coverage is portable, so you are able to continue this policy after you leave the District

The benefits reduce at age 70 or after 10 years of coverage, whichever is the longest.

| Your cost |

|---|